Tims Financial Services of Tim Hortons offers customers simple, convenient, and rewarding ways that help them manage their daily finances.

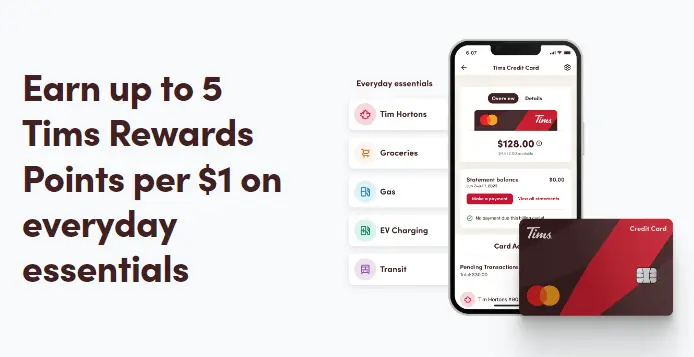

Tims Financial option is available on the Tims Hortons app, where you can sign up, manage your profile, track your points with every purchase, and redeem rewards.

From signing up and the Tims Credit card to their Reward Program, we have everything about Tims Financial covered here, so buckle up.

Take the Tim Hortons customer feedback survey at TellTims.Ca to win exciting rewards.

How to Sign Up to Tim’s Financial Profile?

- Download the Tim Hortons app from the Apple App Store or the Google Play Store on your mobile.

- From the app, click on the Tims Financial button.

- Sign in using your authentication proof (Face ID, Touch ID, Face Unlock, Fingerprint Unlock, Passcode, or Password).

Tims Credit Card

Criteria to Apply for a Tims Credit Card

- You must currently live in Canada and have a residential address for that specific country.

- Reach the age of majority in the territory where you live.

- Have a valid email address.

- One of your identification proofs.

Once you open your Tims Credit Card account, you will receive your Tims Credit Card within 2-3 weeks.

Benefits of Your Tims Credit Card

- Extended Warranty- You can extend the manufacturer’s warranty for most items you purchase using your Tims Credit Card for up to one year.

- Purchase Protection: You get insurance against the lost, robbed, and damaged items bought with the Tims Credit Card.

- MasterCard Zero Liability: You get protection against unauthorized purchases on your card.

Minimum Payment on Your Tims Credit Card

The following factors are added to calculate your minimum Tim credit Card due statement:

- The greater one is given preference, $10.00 or 2.05 of your total statement balance.

- All outstanding interest and fees are due on your credit card account.

- The amount that exceeds your credit limit or any amount not paid yet – the greater one is given preference.

Also, if the statement balance on your Tims Credit Card is less than $10.00, you must pay in full by the due date shown within the statement.

Tims Reward Program

How You Earn Points Using Your Tims Credit Card

Here’s how you can segregate points with items purchased on your Tims Credit Card:

- At the Tim Hortons Restaurant, you earn 15 points for every $1 you spend.

- For groceries, gas energy, electronic vehicle charging, and transit (including the taxis and rides), you get 5 points for every $1 bill.

- For places apart from the ones mentioned above, you can earn up to 1 point for every $2 you spend.

How to Make Sure You Earn All Your Points?

- Use Scan and Pay

- Set your Tims Mastercard as the priority transaction method on your Tim Hortons app.

- Turn the Scan & Pay feature on and use it at the counter (when in the restaurant).

- Use the Credit Card

- Use the Tims Credit Card only to earn 5 points for every $1 you spend.

- Scan separately for Tims Rewards to earn 10 points for every $1 spent.

Also, note that if you want to redeem a reward, the minimum number of points you will need is 300.

Another thing to note is you earn the Tims Reward Points on every dollar you spend after tax.

So, for example, if you earn 15 points for every $1 spent, it is calculated before tax.

Official website: timsfinancial.ca.