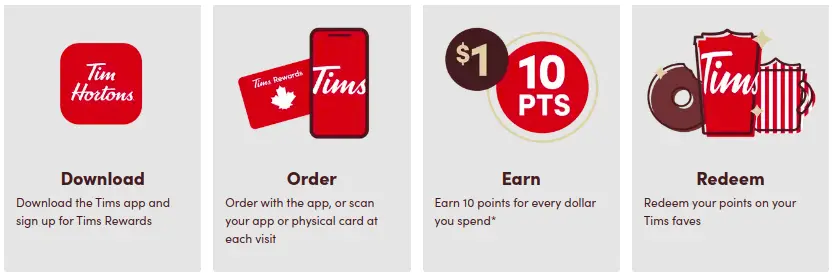

In a world where loyalty programs are a dime a dozen, Tim Hortons, the beloved Canadian coffee giant, has stepped up its game with Tims Rewards.

This article will deeply dive into the Tims Rewards program and how the Tims Credit Card can supercharge your loyalty game.

Take Tim Hortons customer experience survey at the Tell Tims Canada survey website.

Welcome Offer: A Delicious Start

First things first, let’s talk about the enticing welcome offer. When you open your Tims Credit Card account, you can earn up to 5,000 Tims Rewards Points.

- The process is simple: purchase within 30 days of opening your account and watch the points roll in.

- But it doesn’t stop there. Over the next three months, if you spend $200 or more each month, you’ll continue to accumulate points.

- It’s a limited-time offer, so be sure to apply by September 24, 2023, to take full advantage of this generous offer.

Earning Points Everywhere You Shop

The Tims Credit Card takes the concept of “everyday essentials” to the next level. You can earn up to 5 Tims Rewards Points for every $1 you spend on gas, groceries, EV charging, and transit, including taxis and ridesharing.

But the cherry on top is the staggering 15 points per $1 you can earn at the restaurants of Tim Hortons whenever you scan for the Tim Rewards. It means that your daily coffee run could fuel your next Timbit adventure. And for those purchases outside these categories, you still earn 1 point for every $2 spent.

Redeem Points for Your Tims Faves

Accumulating points is exciting, but the real magic happens when you redeem them for your Tim Hortons favorites. Whether it’s a comforting double-double, a box of assorted Timbits, or one of their delectable sandwiches, your points can transform into delicious rewards.

The Secured Card Option

Tim Hortons understands that only some have a perfect credit history. That’s why they offer a secured version of the Tims Credit Card. With this version, you can still earn points everywhere you shop, albeit at a slightly reduced rate.

When you scan for Tim Rewards, you’ll get 2 points per $1 on groceries, gas, and transit, plus 12 points per $1 at Tim Hortons restaurants. It’s an inclusive approach that ensures everyone can enjoy the perks of Tims Rewards.

Transparent Fees and Rates

Tim Hortons knows that transparency is vital when it comes to credit cards. The Tims Credit Card comes with no annual fee, making it an affordable addition to your wallet.

The purchase interest rate varies between 20.99% and 25.99%, with a slightly lower range for Quebec residents. Cash advances come with an interest rate of 22.99% to 27.99%, again with a lower capacity for Quebec. These transparent and competitive rates ensure you know what you’re getting into.

A Commitment to Quality

Tim Hortons has always been about more than just coffee and donuts. They’re committed to quality and value, and their partnership with industry leaders like Neo Financial™ and Mastercard® reflects this commitment. By collaborating with these giants, they can offer you the best products and services.

Ending Words

Tim’s Credit Card is not just a credit card. It’s a passport to a world of delicious rewards. With an enticing welcome offer, the opportunity to earn points on everyday purchases, and transparent fees, it’s a card that’s hard to resist for any Tim Hortons enthusiast.